are closed end funds riskier

CEFs are riskier investments compared to most other bond portfolios. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital.

Closed-end assets are riskier than open-end assets which is fine for those with a long time horizon.

. Closed-end funds have broker trading fees and are considered riskier than open-ended mutual funds. Thats clear and should be stated again and again. If lots of investors buy shares the price goes up.

That is they invest using borrowed money in order to multiply their potential returns. But the reward for the risk assumed is for most investors worth it. CEFs share some traits with traditional open-end mutual funds.

See also What are standardized variables in an experiment. The longer you plan on staying invested the longer you have to make up for declines should something go wrong. Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below.

Closed-End Fund Drawbacks The risks associated with this type of fund mainly include market risk and how that can affect pricing. While all investments come with some form of risk closed-end funds carry more risk than others. Ad If you LIKE dividends youll LOVE Dividend Detective.

The value of a CEF can decrease due to movements in the overall financial markets. Most closed-end funds are owned by individual investors. You Arent Worried About Liquidity.

Some traditional mutual funds also use leverage. If stocks experience a bout of volatility then that can cause fund prices to fluctuate as well. With the CEF market value largely driven by.

BlackRock MuniHoldings California Quality Fund Inc. A closed-end fund is not a traditional mutual fund that is closed to new investors. While a closed-end fund wont have to fear losing capital investors who bought.

For example suppose a closed-end fund had 100 of net assets and invested everything into bonds. In a downturn investors may want to flee from anything perceived as a risky bet. Closed-end funds are considered a riskier choice because most use leverage.

Many closed-end funds do. During down markets many of these investors want to sell their holdings. Their yields range from 632 on average for bond CEFs to.

The risky strategy can pay off when bets go the funds way but losses are magnified when investments go south. Just like open-ended funds closed-end funds are subject to market movements and volatility. Investing in a closed-end fund that is selling at a premium is risky because it means the investors are paying more than the underlying assets are worth.

Interest-rate risk is also something to watch out for if the fund includes a large number of bond holdings. Generally theyre no riskier than their cousins open-ended mutual funds. ETFs trade throughout the day like.

First off closed-end funds in. And even though CEF shares trade on an exchange they are not exchange-traded funds ETFs. Closed-end funds that focus on convertible securitiesbonds are a niche within a niche.

If you are considering investing in a closed-end fund there are some things to be aware of. Closed-end funds create leverage by borrowing at short-term rates then using that money to invest in strategies or instruments providing longer-term returns. If the fund took on 20 of debt to buy more bonds it would receive more income using the same amount of net assets.

4 hours agoAvailability of Fund Updates. Try Closed-End Funds The downside. Many investors might feel more comfortable investing in an ETF.

They can invest in a greater amount of illiquid securities and can use leveraging methods usually avoided by mutual funds. Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility. While it can be riskier can also produce higher returns.

Closed end funds issue a set number of shares at the funds origin that trade on the stock exchange throughout the day. 4 hours agoBlackRock Closed-End Funds 1-800-882-0052. Closed-end funds CEFs can be one solution with yields averaging 673.

Both have an underlying portfolio of investments with a net asset value. If investors dump them the price goes down. Because they are harder to sell they are less liquid than.

Closed-end assets are only able to be sold when another investor is interested in purchasing them. The value of these shares is based on demand. That causes closed-end fund discount to net asset value to widen.

However leverage increases the funds price volatility as well creating more risk for the investor. BlackRock will update performance and certain other data for the BlackRock closed-end funds on a monthly basis on its website in the Closed-end Funds section of www. Symbol Last Price Change Change.

Can I sell a closed-end fund. Closed-end funds may not be ideal for investors looking for riskier investments that offer bigger returns than safer ones.

Guide To Closed End Funds Money For The Rest Of Us

Want Income Closed End Funds Offer Yield But Beware Of The Risks Stock News Stock Market Analysis Ibd

Closed End Fund Muni Market Update December Yields Up To 4 85 Tax Free Seeking Alpha

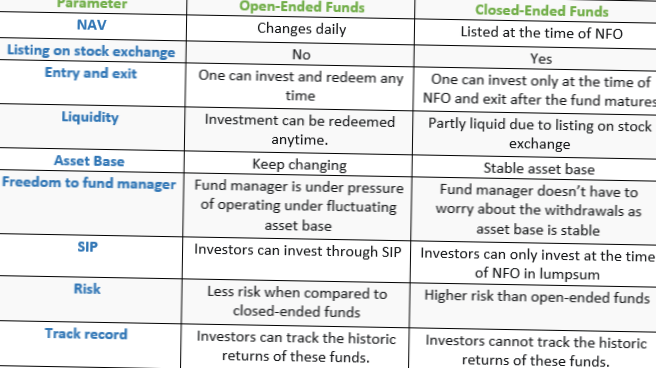

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

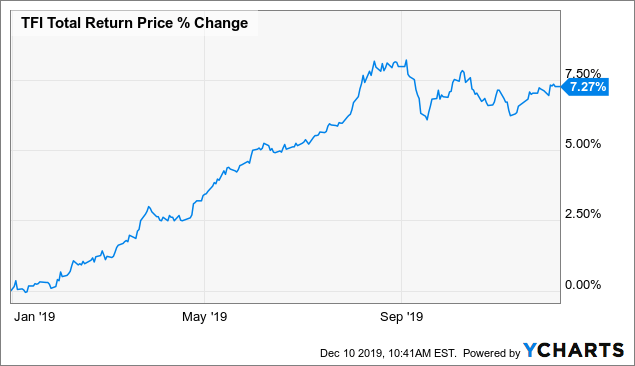

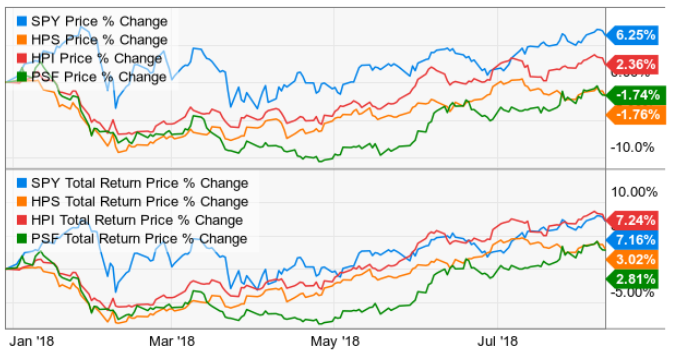

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

Guide To Closed End Funds Money For The Rest Of Us

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Want Income Closed End Funds Offer Yield But Beware Of The Risks Stock News Stock Market Analysis Ibd

What Is A Closed End Fund Quora

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Difference Between Open Ended Funds Vs Close Ended Funds

Guide To Closed End Funds Money For The Rest Of Us

Preferred Stock Closed End Funds Reviewing The Category Seeking Alpha

What Is Closed End Investment Fund Quora

Closed End Funds Basics How It Works Pros Cons The Smart Investor

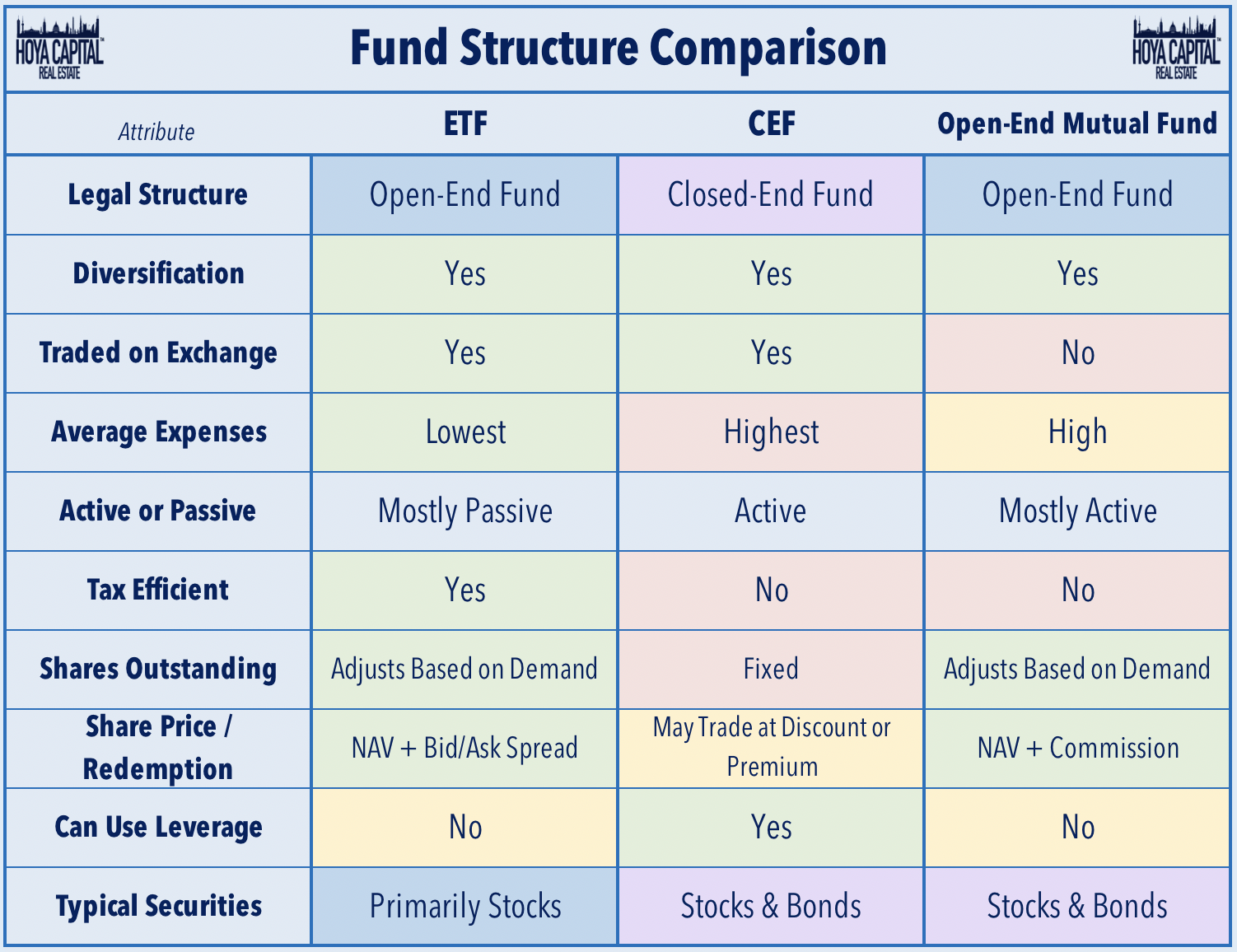

Etf V S Open Ended Fund And Close Ended Fund Financial Management Latest Business News Stock Market

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Is A Closed End Fund And Should You Invest In One Nerdwallet